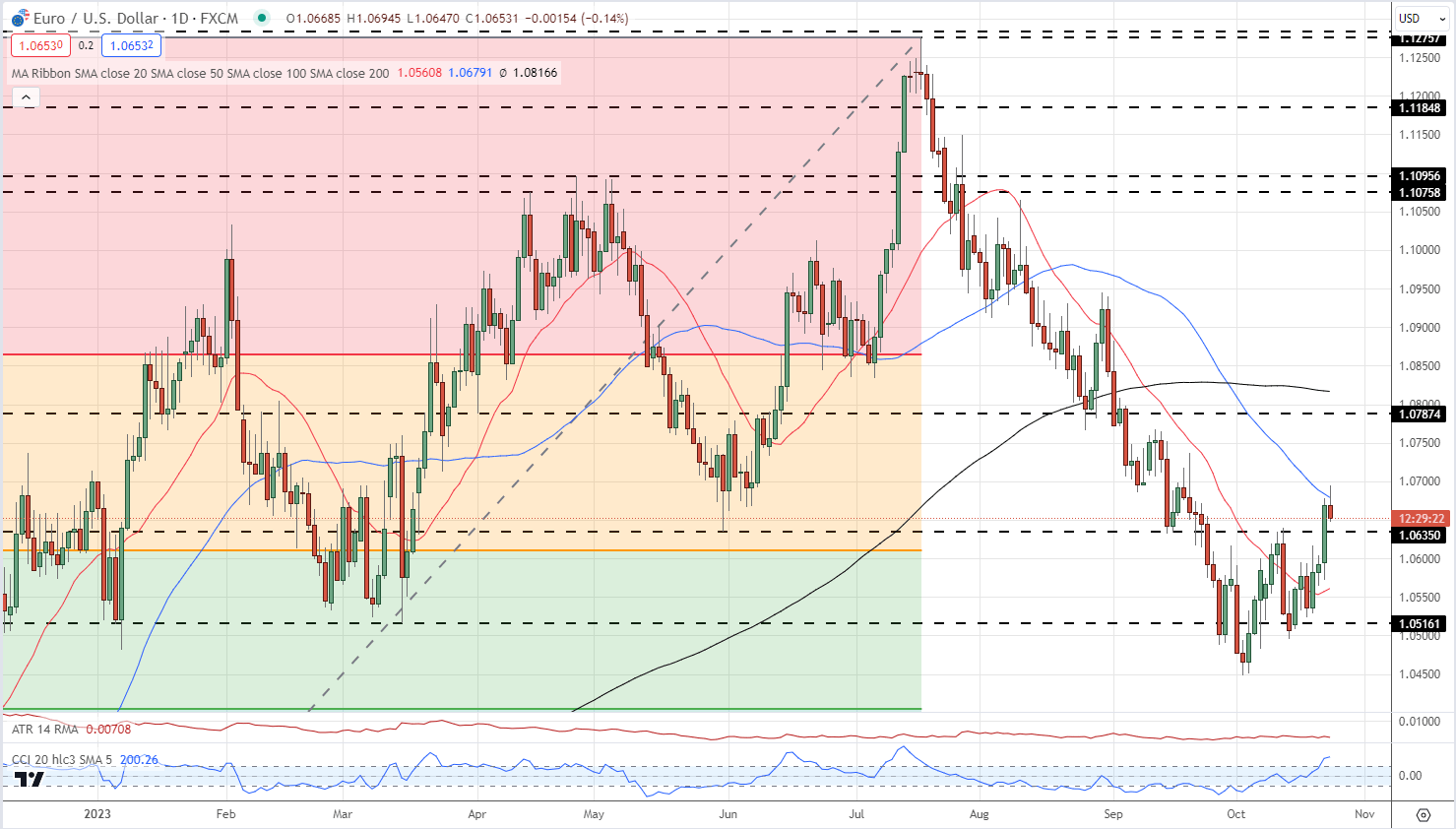

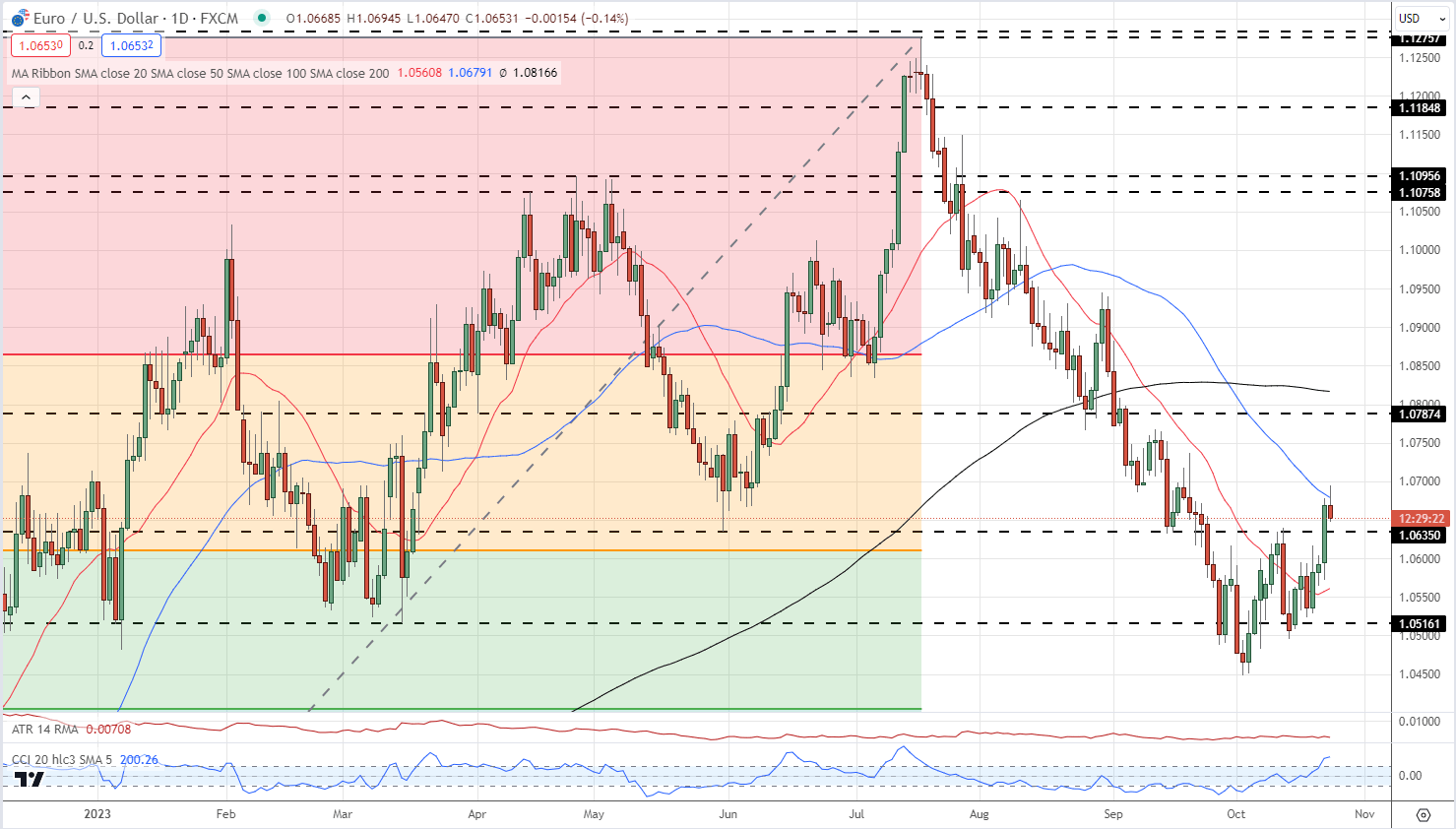

EUR/USD faces selling pressure around 1.0780 amid a stronger USD, maintaining a bearish stance below crucial Exponential Moving Averages (EMA) on the four-hour chart. The Relative Strength Index (RSI) stays below the 50 midline, indicating a downward path. Key resistance lies at 1.0840, while initial support rests at 1.0752.

During the early European session on Monday, EUR/USD remains defensively positioned, influenced by hawkish remarks from Fed Chairman Jerome Powell, supporting the US Dollar (USD). The pair is currently trading at 1.0780, reflecting a 0.11% loss for the day.

Powell, speaking on Sunday, dismissed the possibility of a rate cut in March, citing insufficient confidence in inflation reaching the 2% target sustainably. The Fed emphasized the need for greater assurance before considering significant steps like rate cuts.

From a technical perspective, the bearish outlook persists as EUR/USD stays below the key 100-period EMA, displaying a downward slope on the four-hour chart. The RSI below the 50 midline reinforces downward momentum.

Looking ahead, the immediate hurdle for the pair is near the 50-period EMA at 1.0840, followed by the 100-period EMA at 1.0865. A breakthrough could lead to a test of the critical barrier at 1.0900, marked by the upper boundary of the Bollinger Band and a psychological level. Further upside targets include the January 15 high at 1.0967 and the psychological round figure of 1.1000.