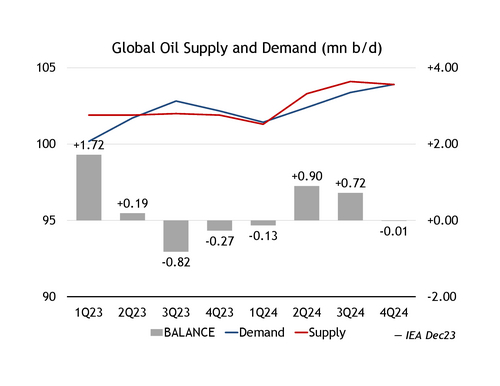

IEA: 2024 world oil demand growth forecast raised by 180k bpd

In its monthly oil market report published on Thursday, the International Energy Agency (IEA) lifted the global oil demand growth forecast for 2024. Key takeaways 2024 world oil demand growth forecast raised by 180k bpd to 1.24 mil bpd. Economic outlook has improved over the last few months amid dovish pivot in central bank policy. Q4 2023 slump in oil prices to act as additional tailwind. Strong growth from non-OPEC+ producers could lead to substantial surplus if OPEC+ cuts are unwound. Barring significant disruptions to oil flows, market looks reasonably well supplied in 2024. Market reaction WTI keeps its consolidative mode intact at around $73 on the above findings, up 0.23% on the day. WTI OIL FAQS What is WTI Oil? WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media. What factors drive the price of WTI Oil? How does inventory data impact the price of WTI Oil How does OPEC influence the price of WTI Oil? Share: Share on Twitter Share on Facebook Copy to clipboard Feed news