USD/INR drifts lower ahead of Indian CPI data

- Indian Rupee edges higher in a quiet session on Monday

- The Reserve Bank of India (RBI) is expected to cut rates by 25 bps in each of the third and fourth quarters.

- Investors await India’s CPI inflation data due on Monday at 12:00 GMT.

Indian Rupee (INR) recovers on Monday amid muted early trading, with most Asian markets closed. India’s Consumer Price Index (CPI) for January will take center stage at the beginning of the week. The Reserve Bank of India (RBI) maintained its repo rate at 6.50% for a sixth consecutive meeting on February 8, citing food price shocks as a significant risk to the current disinflation trend.

The Indian central bank is anticipated to leave its key policy rate unchanged until the June meeting before cutting it by 25 basis points (bps) in each of the third and fourth quarters, a relatively moderate move compared to other major central banks’ easing cycles.

On the other hand, the robust US economic data and pushback from Fed officials on market expectations of early rate cuts boost the USD and lift the US bond yield, which acts as a tailwind for the USD/INR pair.

Moving on, India’s CPI inflation data, Industrial Production, and Manufacturing Output are due on Monday at 12.00 GMT. The Wholesale Price Index (WPI) Food, Fuel, and Inflation for January will be released on Wednesday.

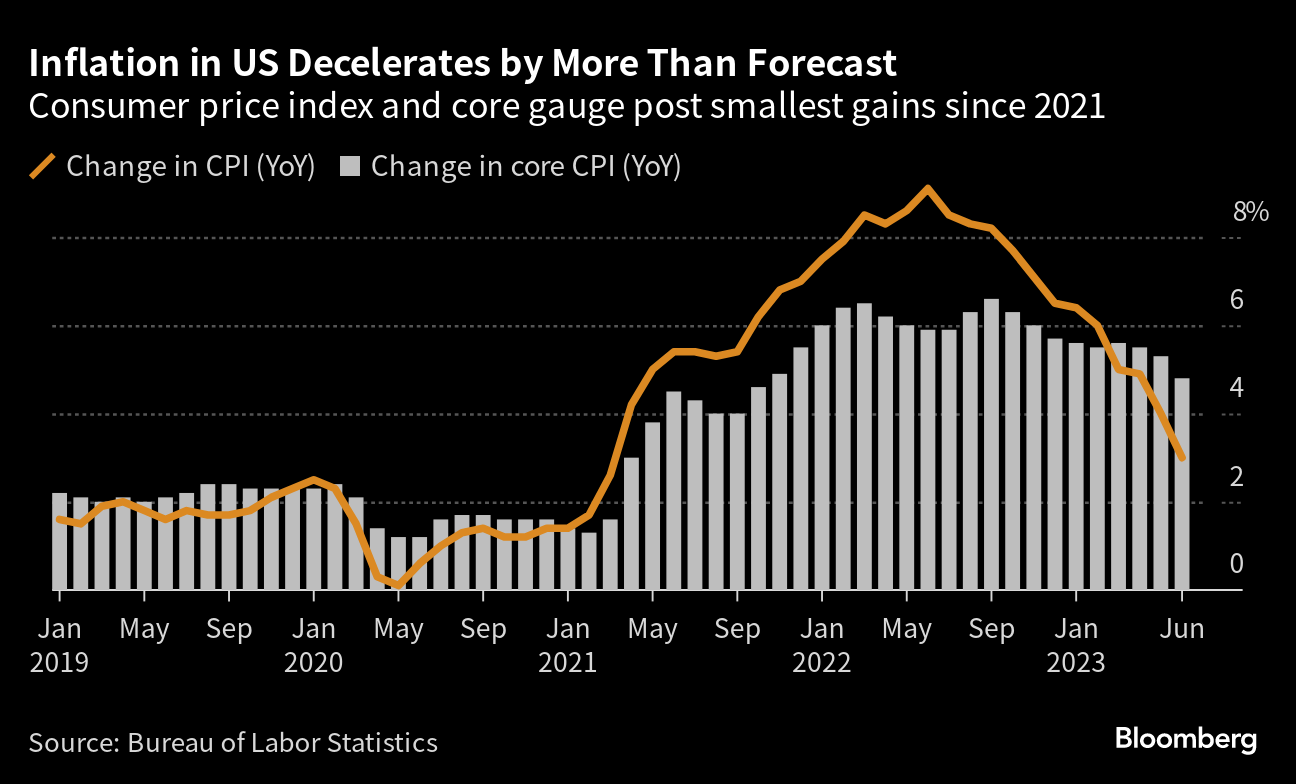

On the US docket, the January CPI report will be in the spotlight on Tuesday. The headline Consumer Price Index (CPI) is expected to slow from 3.4% in December to 3.0% in January. The inflation reports over the next few months could be critical in determining the timeline for when the Fed will cut its benchmark interest rate.