Japanese Yen hangs near YTD low against USD, looks to US CPI on Tuesday for fresh impetus

The Japanese Yen (JPY) faces a lack of clear direction on Monday, hovering within a narrow range against the US Dollar (USD) as the European session begins. Last week’s dovish comments from Bank of Japan (BoJ) Deputy Governor Shinichi Uchida, coupled with a generally positive risk sentiment, restrict the JPY’s upward potential. Uchida’s remarks, indicating a cautious stance on aggressive tightening even after moving away from negative interest rates, weigh on the JPY’s outlook.

However, sustained expectations for a potential shift in BoJ policy, particularly with anticipation of significant wage increases from large Japanese firms, provide some support for the JPY, particularly in limiting downside losses.

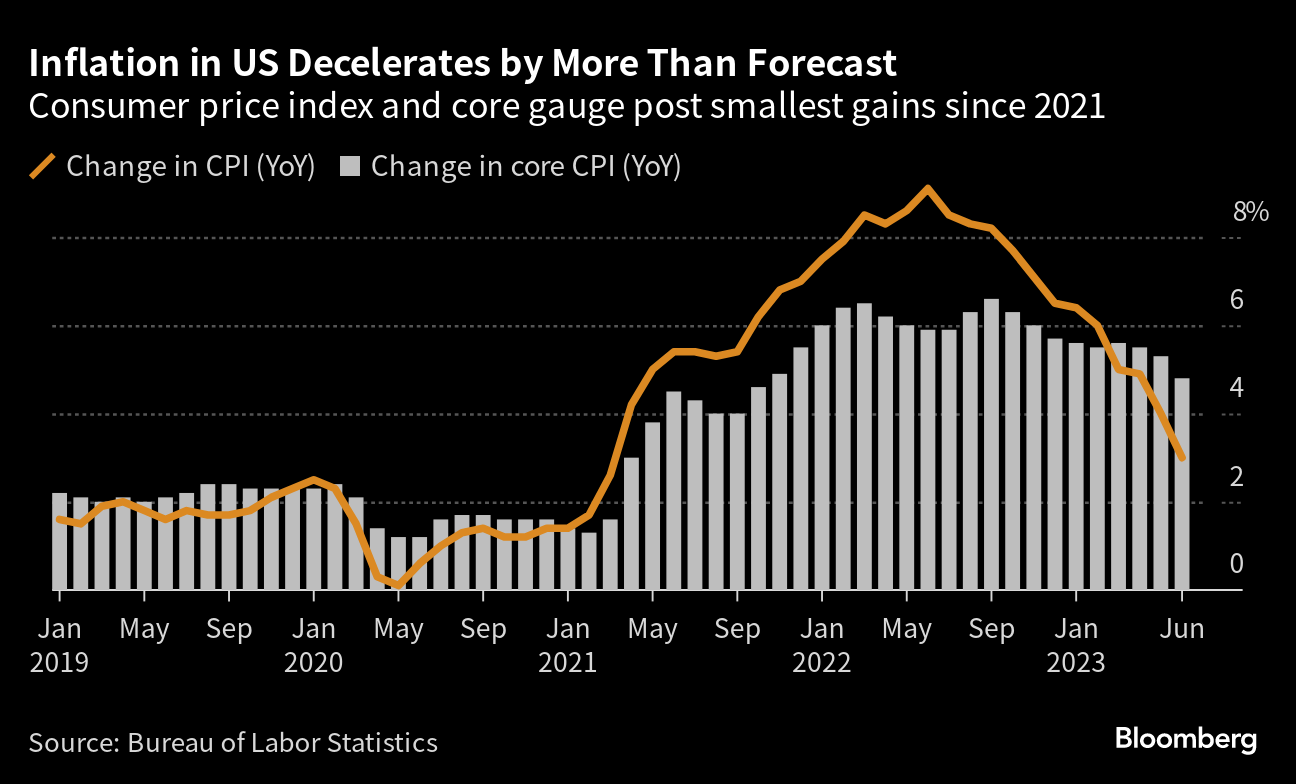

Meanwhile, the USD struggles to attract buyers amid uncertainty surrounding the Federal Reserve’s (Fed) stance on interest rate cuts. This uncertainty translates into limited influence on the USD/JPY pair, resulting in a range-bound trading pattern. Traders are awaiting key data releases, notably the US consumer inflation figures scheduled for Tuesday, which are expected to provide insights into the Fed’s rate-cut trajectory. The outcome of this data will likely dictate near-term trends in USD demand and determine the currency pair’s direction.

In the absence of significant US macroeconomic data on Monday, the pair is likely to continue its consolidative phase, with spot prices remaining within a tight range until fresh cues emerge.