Silver Price Analysis: XAG/USD attracts some buyers below $23.00, focus on US CPI data

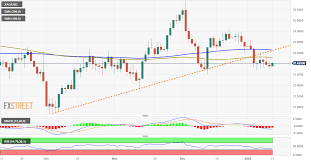

In Monday’s early European session, silver (XAG/USD) continues to gather momentum, trading near $22.80. The bullish sentiment remains robust, particularly as the metal maintains its position above the key Exponential Moving Average (EMA). Initial support is observed around $22.70, while the key resistance level is identified at $23.00.

Silver’s upward trajectory is reinforced by ongoing trader focus on the US January Consumer Price Index (CPI) data scheduled for release on Tuesday. Should the CPI data confirm a declining inflation trend, it may bolster expectations for rate cuts, thus supporting silver prices further. Currently, XAG/USD is up 0.82% on the day, hovering around $22.80.

A closer look at the four-hour chart reveals that silver’s bullish trend remains intact, with the metal comfortably positioned above the crucial 100-period Exponential Moving Average (EMA). The Relative Strength Index (RSI) is also above the 50 midline, indicating favorable momentum for potential further upside.